The True Cost of Apparel Returns: Alarming Return Rates Require Loss-Minimization Solutions [Research]

Discover the startling impact of apparel returns on the fashion industry in this insightful survey-based research by 3DLOOK and Coresight Research, which highlights the urgent need for effective loss minimization solutions to tackle the alarming return rates.

Share on

Sunny Zheng, Analyst

Coresight Research

Sunny Zheng, Analyst

Coresight Research

EXECUTIVE SUMMARY

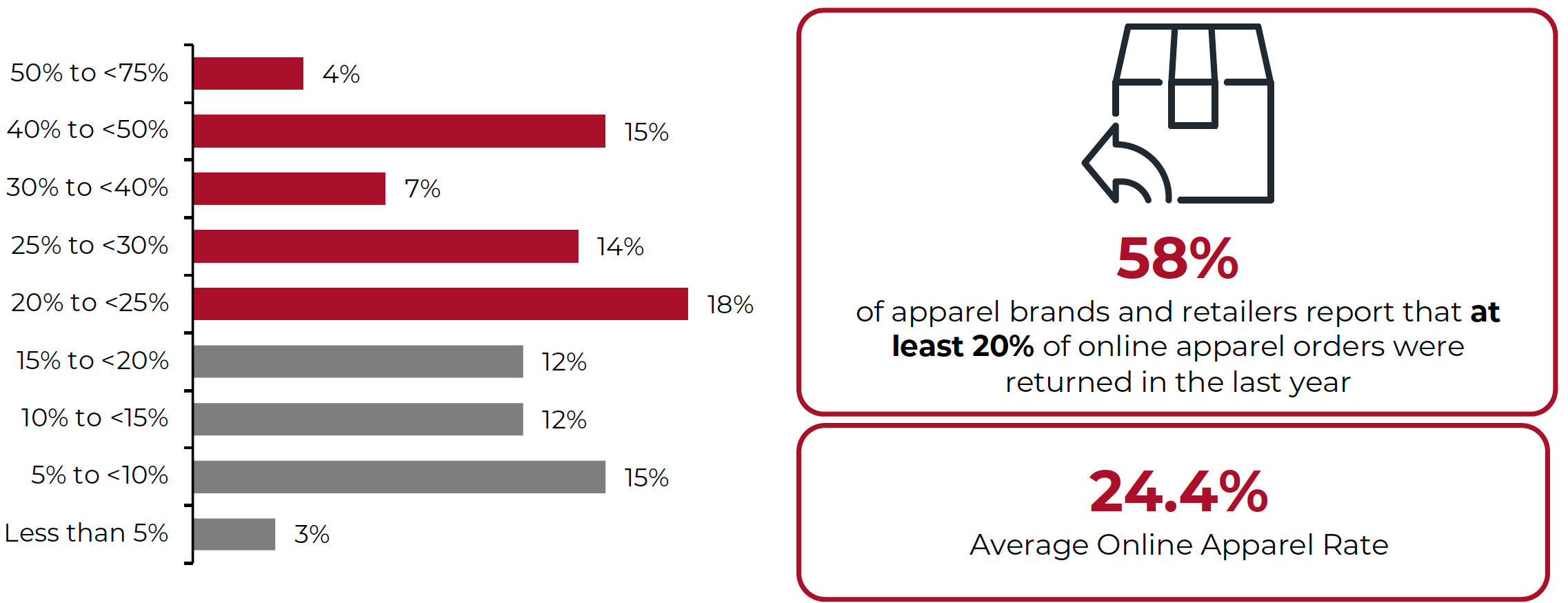

Market Scale and Opportunity

The average return rate of online apparel orders in the US is 24.4%, Coresight Research estimates, based on a proprietary survey of decision-makers at US-based apparel brands and retailers. Based on our estimate of a total $155.8 billion online apparel and footwear market in 2023, a 24.4% return rate would translate to $38 billion in returns, with an estimated $25.1 billion in processing costs in 2023. These alarming numbers indicate the need for retailers to implement loss-minimization solutions.

Coresight Research Analysis

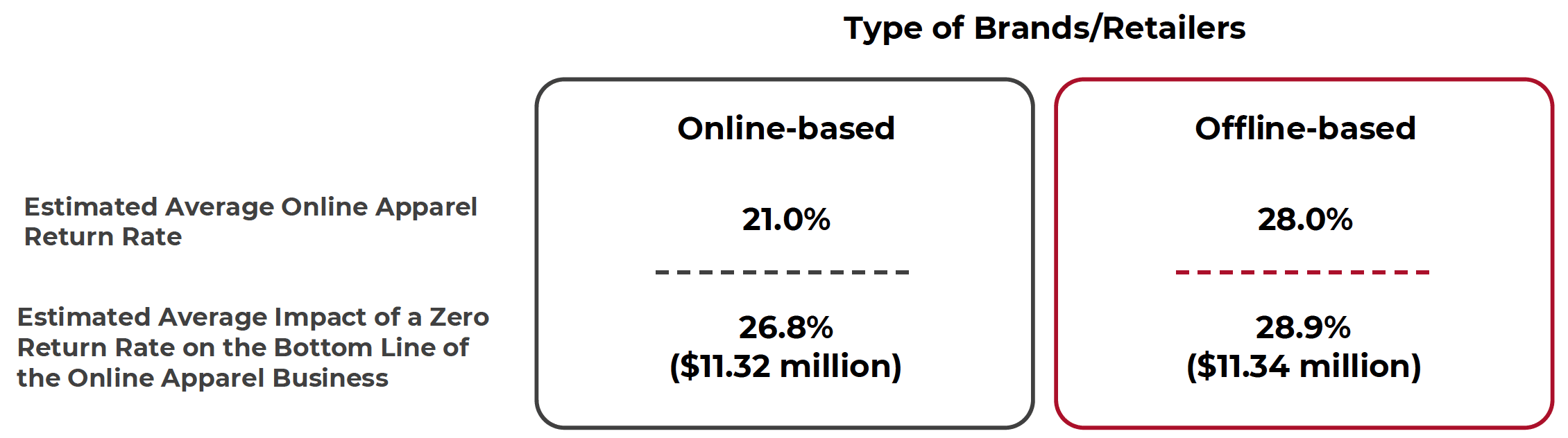

- Our survey found that offline-based apparel companies have a higher online apparel return rate, on average, compared to online-based apparel companies. On average, respondents from offline-based companies estimate that returns reduce their bottom line by 28.9%, which translates to an average of $11.34 million.

- The top three reasons for online apparel returns in the past 12 months, according to surveyed apparel brands and retailers, are size/fit (53% of respondents), color (16%) and damage (10%). Apparel categories including pants, shirts/blouses, dresses and outerwear or jackets were returned more often than categories including suits, skirts and undergarments/lingerie.

- Apparel brands and retailers are adopting different approaches, including changing returns policies and leveraging virtual try-on technology, to reduce returns: our survey found that a huge 85% of apparel brands and retailers either currently use or plan to implement virtual try-on tools. Such tools can also drive initial sales as well as reducing returns. Among the 29% of apparel brands and retailers that already have a size-recommender tool, 80% reported that it increases conversion.

What We Think

E-commerce acceleration has negatively impacted the rate of returns in apparel, as customers struggle to visualize products in terms of the look, feel and size/fit of items. As incorrect sizing is the top reason for online apparel returns, apparel brands and retailers can turn to technologies such as 3D body scanning to solve for the burgeoning returns challenge. As solution providers continue to improve the accuracy and user experience of sizing tools, they have potential to provide new levels of personalized customer service in stores and online, which could lead to a shift in the US apparel market.

INTRODUCTION

The high return rate is a growing issue for apparel brands and retailers, substantially impacting revenues and costs, customer satisfaction and loyalty, as well as sustainability. Leveraging findings from a proprietary survey of apparel retailers in the US, we estimate current online apparel return rates, identify the most common reasons for returns and uncover brands’ and retailers’ next steps in reducing returns.

ALARMING RETURN RATES REQUIRE LOSS-MINIMIZATION SOLUTIONS: CORESIGHT RESEARCH ANALYSIS

A 24.4% Online Apparel Return Rate Means $38 Billion Returns

Based on a Coresight Research survey of decision-makers at US-based apparel brands and retailers, we estimate that the average return rate of online apparel orders was 24.4% for the 12 months ended March 6, 2023. This rate is 7.9 percentage points higher than the average online return rate of 16.5%, according to National Retail Federation. Consumers who shop apparel and footwear online are more likely to return products compared to in-store shoppers and compared to other categories, because it is hard to visualize how apparel products will look or fit.

Coresight Research estimates that the online apparel and footwear market will total $155.8 billion in 2023, so a 24.4% return rate would translate to $38 billion in returns this year.

Some 45% of survey respondents reported that their companies’ apparel return rates increased moderately or significantly over the last two years, highlighting growing challenges amid the recent acceleration in e-commerce.

The alarming returns numbers indicate the need for retailers to implement loss-minimization solutions.

Base: 100 decision-makers at US-based apparel brands and retailers, surveyed on March 6, 2023

Source: Coresight Research

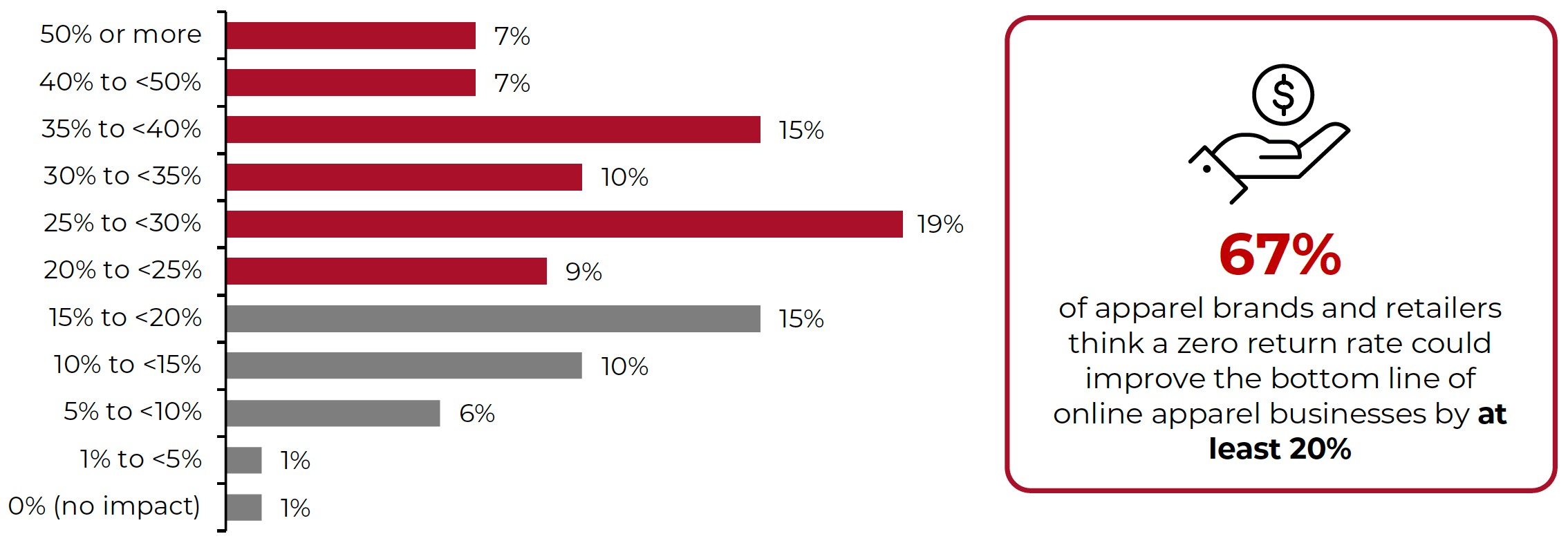

Reducing the Cost of Returns Leads to Improved Margins

The majority of surveyed apparel companies (98%) offer customers free shipping on returns of online orders, according to our survey. The combined costs of shipping, processing and restocking can have a significant impact on a retail company’s bottom line. One estimate from Optoro, a reverse logistics technology company, found that it typically costs a company 66% of the price of a product to process a return. We calculate that a 24.4% online apparel return rate could generate $25.1 billion in processing costs in 2023, excluding merchandise waste.

Considering all the costs associated with apparel returns from online orders, 67% of brands and retailers think that a zero return rate could improve the bottom line of their online apparel business by at least 20% (see Figure 2).

Base: 100 decision-makers at US-based apparel brands and retailers, surveyed on March 6, 2023

Source: Coresight Research

Online-Based vs. Offline-Based Companies’ Return Rates

Based on our survey, we found that the online apparel return rate is higher for offline-based companies (whose majority of apparel revenues are generated offline) than online-based companies (whose majority of apparel revenues are generated online)—meaning that a zero return rate would result in a greater bottom-line improvement for offline-based companies, on average (see Figure 3). This is unsurprising, as offline-based companies likely have less mature online capabilities.

Notably, respondents from online-based companies with reported online apparel revenue of over $100 million said that the impact of zero returns would be over 50%.

Base: 100 decision-makers at US-based apparel brands and retailers, surveyed on March 6, 2023

Source: Coresight Research

Trends in Online Apparel Returns

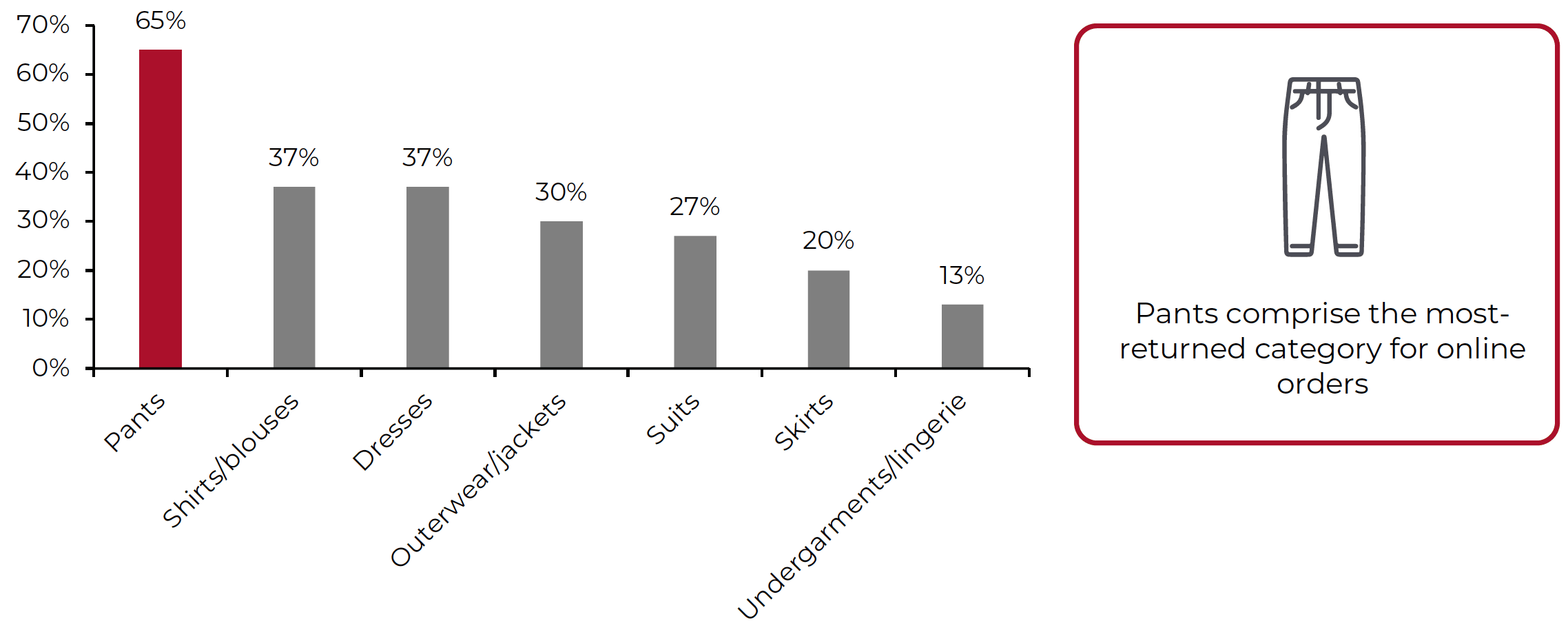

In terms of apparel categories, 60% of surveyed apparel companies reported that some are returned “more often” than others. Apparel categories including pants, shirts/blouses, dresses and outerwear/jackets are returned more often than suits, skirts and undergarments/lingerie.

Base: 60 decision-makers at US-based apparel companies who said that certain apparel categories are returned more often than others, surveyed on March 6, 2023

Source: Coresight Research

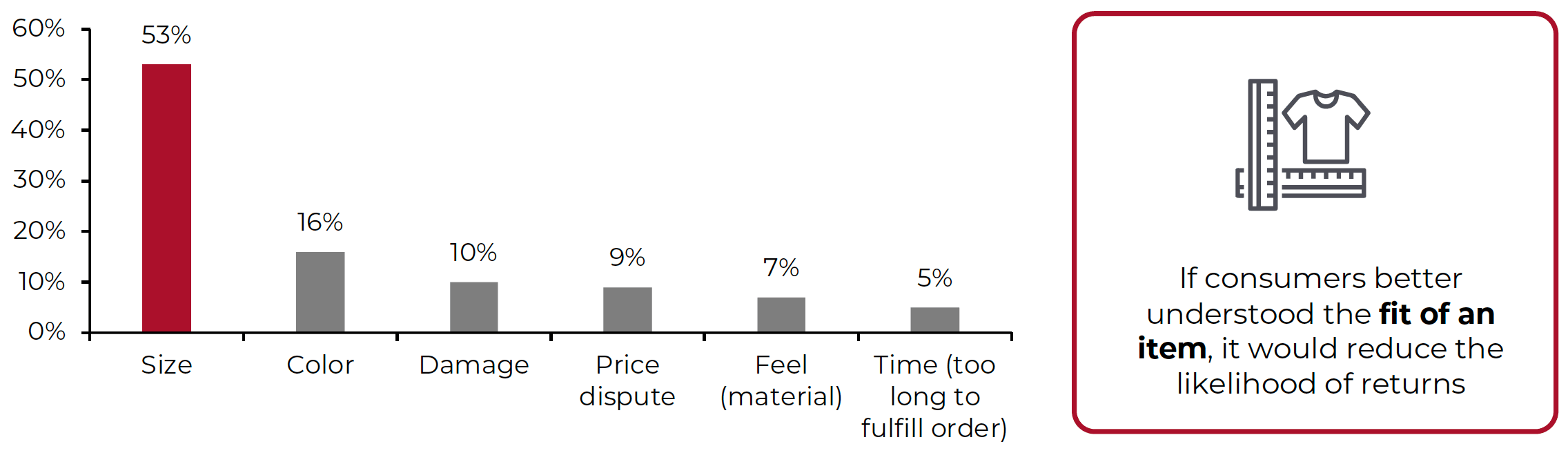

Our survey identified that the top reason for online apparel returns across all categories is size/fit, cited by 53% of all respondents, followed by color (16%) and damage (10%).

Base: 100 decision-makers at US-based apparel brands and retailers, surveyed on March 6, 2023

Source: Coresight Research

Adapting Strategies and Adopting Technology To Reduce Returns

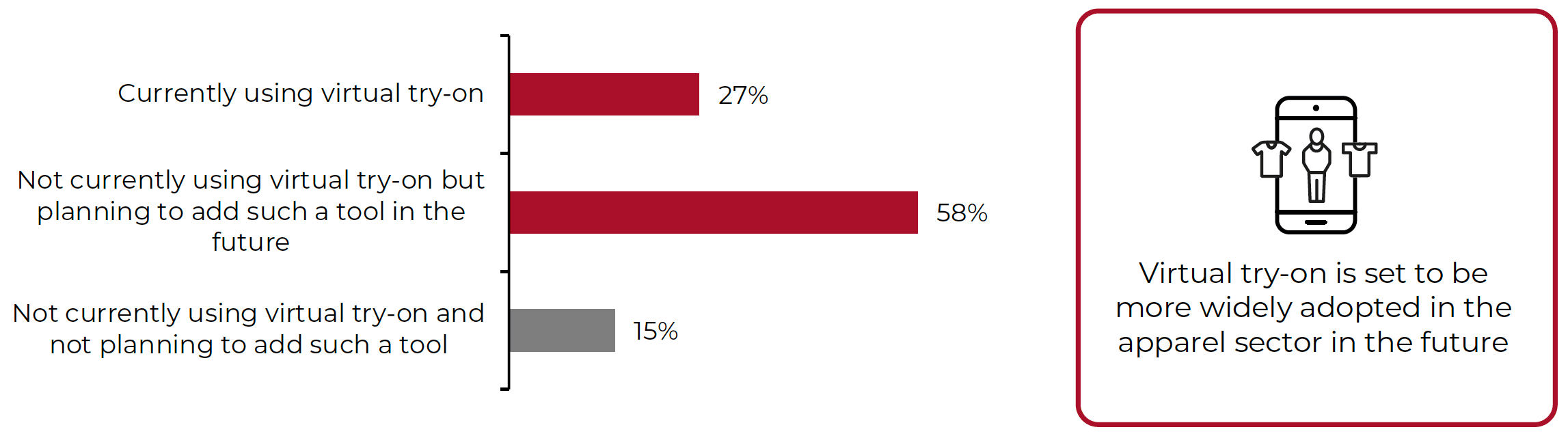

Recognizing the importance of improving shoppers’ understanding of the fit of an item when they make an online purchase, apparel brands and retailers are turning to technology to help reduce returns. Our survey found that a huge 85% of apparel brands and retailers either currently use or plan to implement virtual try-on tools (see Figure 6).

Base: 100 decision-makers at US-based apparel brands and retailers, surveyed on March 6, 2023

Source: Coresight Research

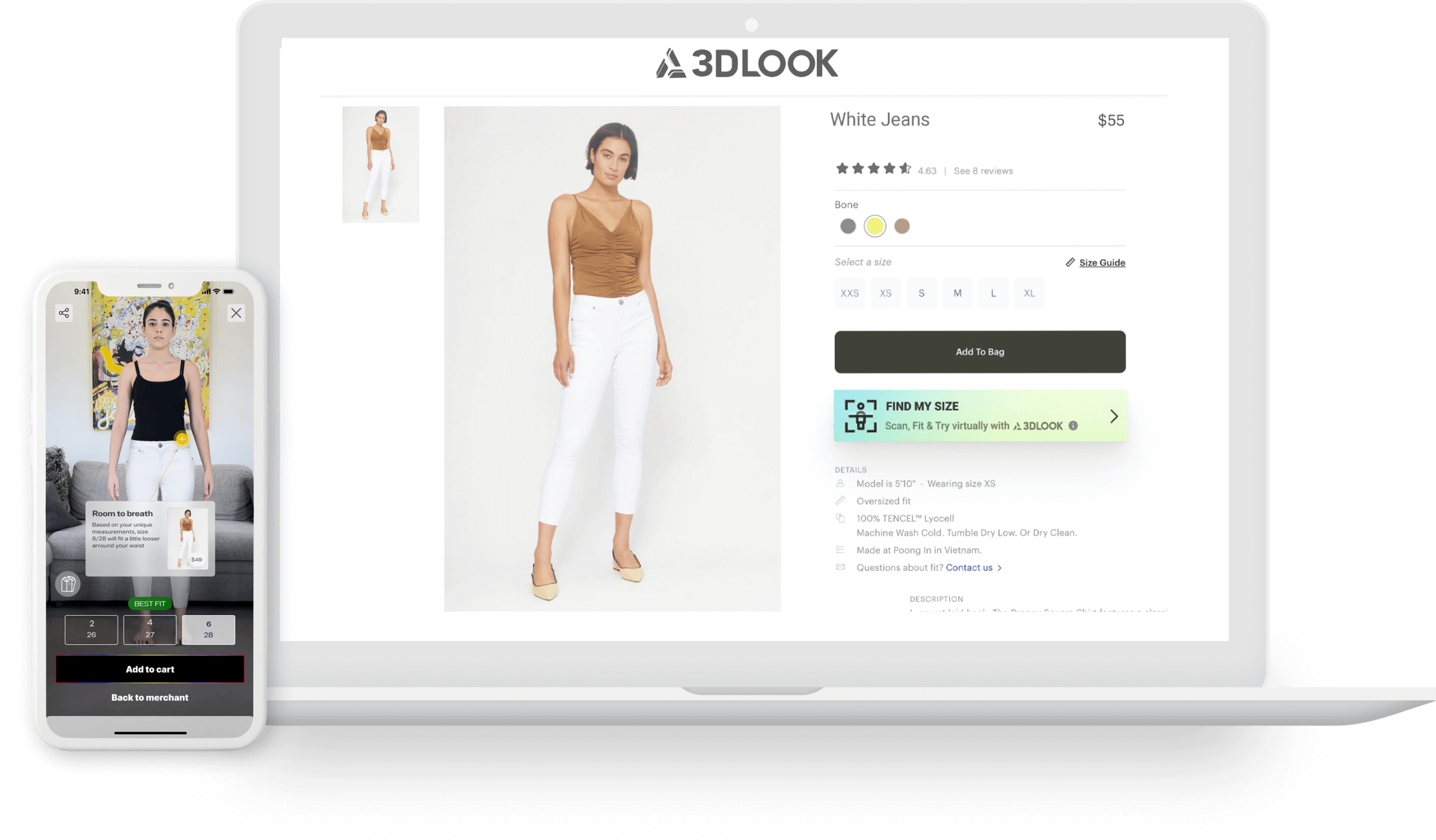

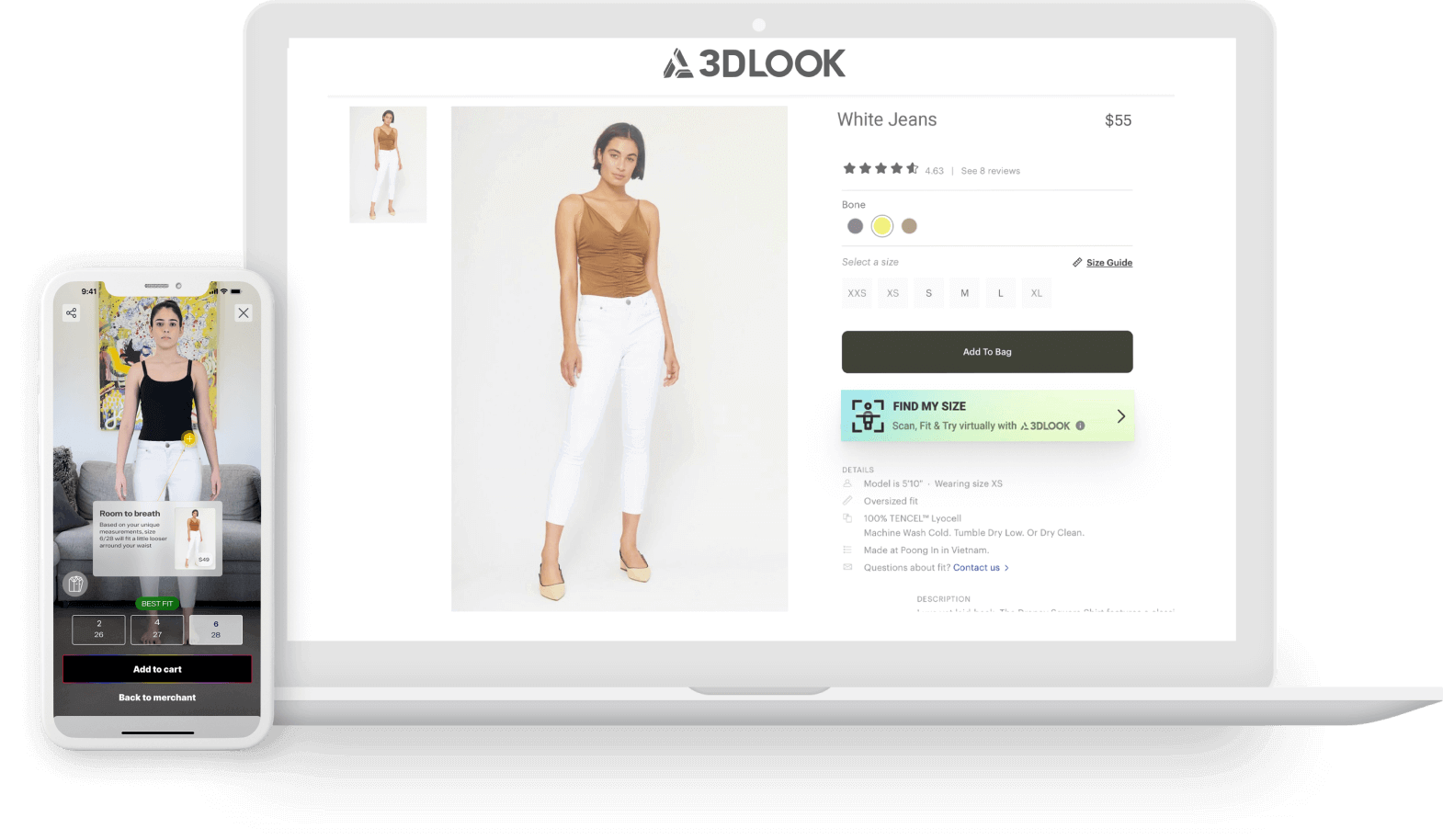

Other tools that help brands boost consumer confidence in their apparel purchase by better understanding the fit of an item include size recommendation and body scanning. 3D body-scanning technology uses a smartphone camera to take measurements of the user’s body and uploads those measurements to provide accurate sizing for online apparel purchases. This reduces returns by making shoppers more likely to buy only one size, which is the right size (rather than buying multiple sizes to try on at home and return the ones that do not fit).

Such tools can also drive initial sales as well as reducing returns. Our survey found that among the 29% of apparel brands and retailers that already have a size-recommender tool, 80% reported that it increases conversion.

A few major apparel brands and retailers have recently adjusted their policies or adopted technologies, including virtual try-on, to reduce returns:

- Gap lowered its returns window to 30 days in June 2022, from 45 days previously.

- In June 2022, Zara began charging its customers $3.95 for online returns to third-party drop-off points.

- Amazon launched virtual try-on for shoes in June 2022 with its new mobile AR (augmented reality) tool.

- Walmart acquired virtual clothing try-on startup Zeekit in May 2021 and enhanced the virtual try-on experience in September 2022 by allowing customers to use their own photos to better visualize how clothing will look on them.

WHAT WE THINK

E-commerce acceleration has negatively impacted the rate of returns in apparel, as customers struggle to visualize products in terms of the look, feel and size/fit of items. Our survey found that incorrect sizing is the top reason for online apparel returns—likely because the industry does not use a standardized sizing system and apparel brands and retailers are unable to capture what the customer really looks like in different styles and sizes of apparel.

Apparel brands and retailers can turn to technologies such as 3D body scanning to solve for the burgeoning returns challenge. As solution providers continue to improve the accuracy and user experience of sizing tools, they have potential to provide new levels of personalized customer service in stores and online, which could lead to a shift in the US apparel market.

Implications for Brands/Retailers

- Proper sizing is often a number-one priority in tackling online apparel returns. By leveraging 3D scanning and size-recommendation technology, brands and retailers can boost consumer confidence in purchases and reduce returns. In addition, they can feed collected customer data into the supply chain to streamline inventory and allow for a more sustainable production model, improved fabric planning and a cleaner environment.

Implications for Technology Vendors

- Technology providers can tap retailers’ demand for loss-mitigation solutions by offering 3D body scanning, virtual try-on and other sizing tools for e-commerce shoppers.

METHODOLOGY

Informing the data in this report is an online B2B survey of 100 decision-makers at US-based apparel brands and retailers, conducted by Coresight Research on March 6, 2023. The results have a margin of error of +/-10%.

Respondents in the survey satisfied the following criteria:

- Brands and retailers that sell products online

- Annual revenue: $10 million or above

- Retail sector: apparel

- Role: Senior Manager or above who are familiar with how their companies manage their apparel business and handle returns

Tags:

Fashion

EXPLORE MORE CONTENT

Subscribe to our Newsletter

Offer your customers an entirely new, inclusive, and engaging way to interact with your brand

Offer your customers an entirely new, inclusive, and engaging way to interact

with your brand

Let us help you find the right solution for your business needs