The Retailer’s Guide to Fashion eCommerce in 2024: Stats, Tips & Trends

An essential guide for fashion retailers in 2024

Share on

The modern consumer appreciates the convenience of being free to shop at any time or place, and the ability to browse stores from every corner of the world to find the best price and styles. These desires have fueled the rise of fashion ecommerce. According to Statista, online sales now make up 20.8% of total retail sales — and further growth is likely. With a year-over-year increase of 4.9%, ecommerce sales are tipped to total 24% of the fashion retail market by 2026.

The modern consumer appreciates the convenience of being free to shop at any time or place, and the ability to browse stores from every corner of the world to find the best price and styles. These desires have fueled the rise of fashion ecommerce. According to Statista, online sales now make up 20.8% of total retail sales — and further growth is likely. With a year-over-year increase of 4.9%, ecommerce sales are tipped to total 24% of the fashion retail market by 2026.

The evolving fashion ecommerce landscape

Where once fashion ecommerce transactions took place almost exclusively on brands’ personal online storefronts, today the landscape spans far and wide, from vast online marketplaces such as Amazon and Zalando, to social media platforms such as Instagram and TikTok, and even the growing number of virtual worlds within the metaverse.

Where early experiences were only available through a desktop computer, now 64% of transactions in fashion ecommerce are carried out using a mobile device, according to IRP. Shoppers can even make purchases through smart speakers and virtual reality goggles, while brands are exploring innovative tools and channels, such as live streaming platforms and virtual dressing rooms, to attract and convert online consumers.

However, ecommerce hasn’t developed without its fair share of problems. Particularly in the fashion space, customers have struggled to find sizes that fit their bodies well and retailers have struggled with sky-high apparel return rates as a result. However, the past decade has seen the development of innovative ecommerce fashion solutions that address these pain points and elevate the online shopping experience.

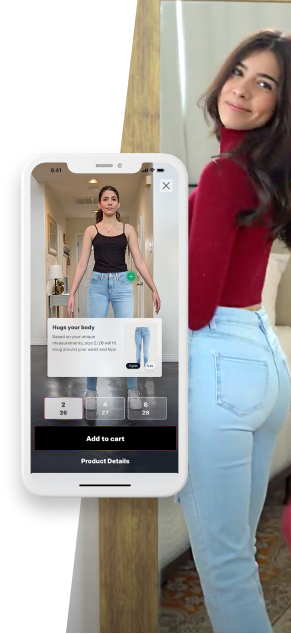

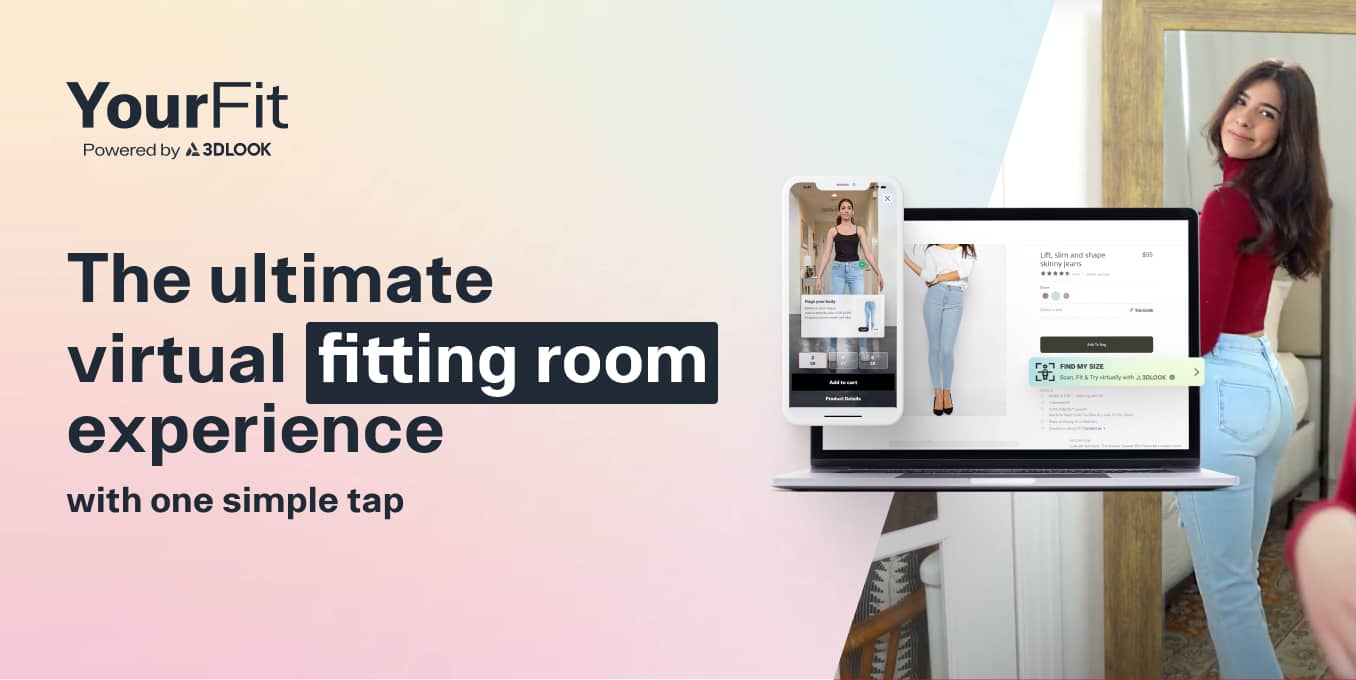

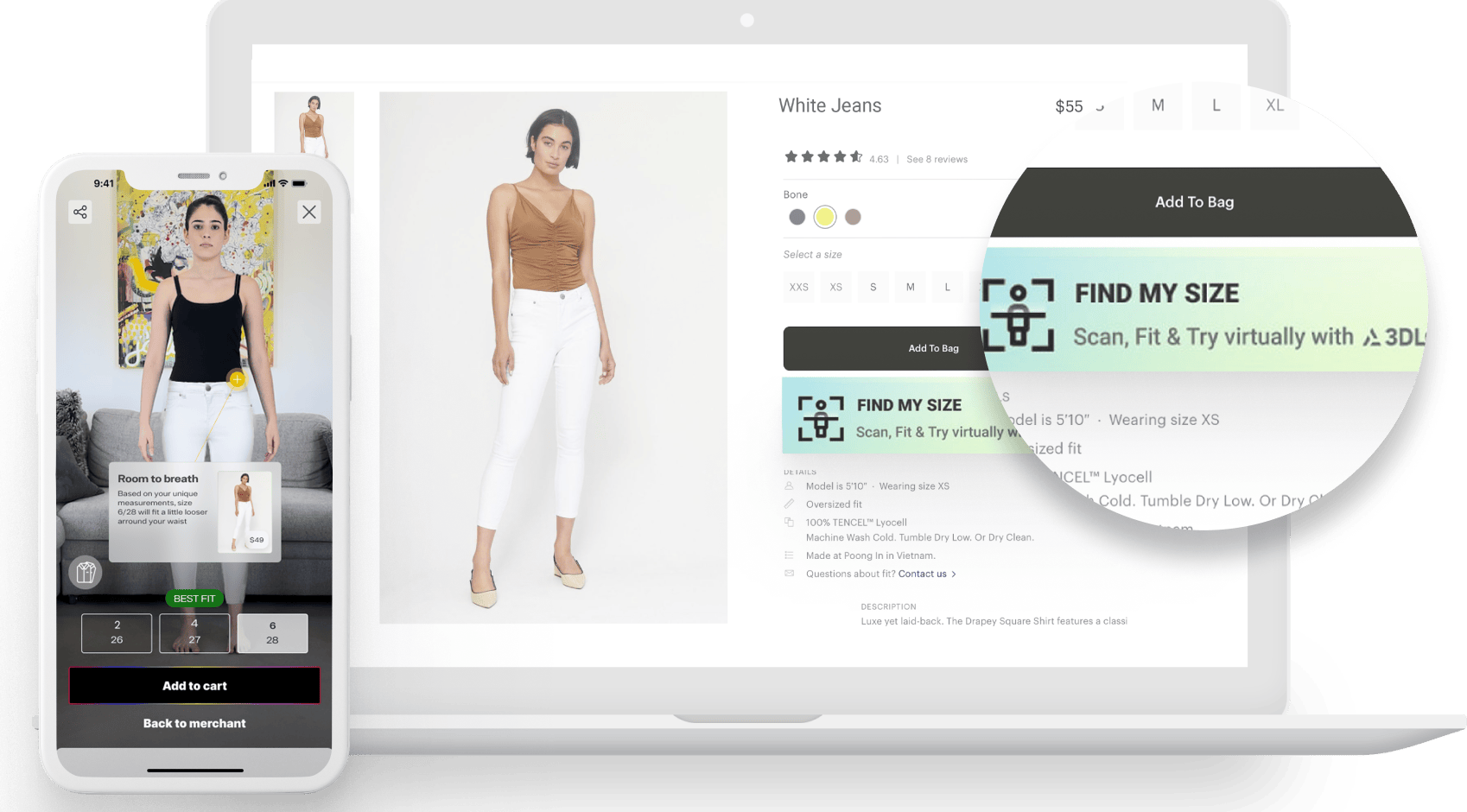

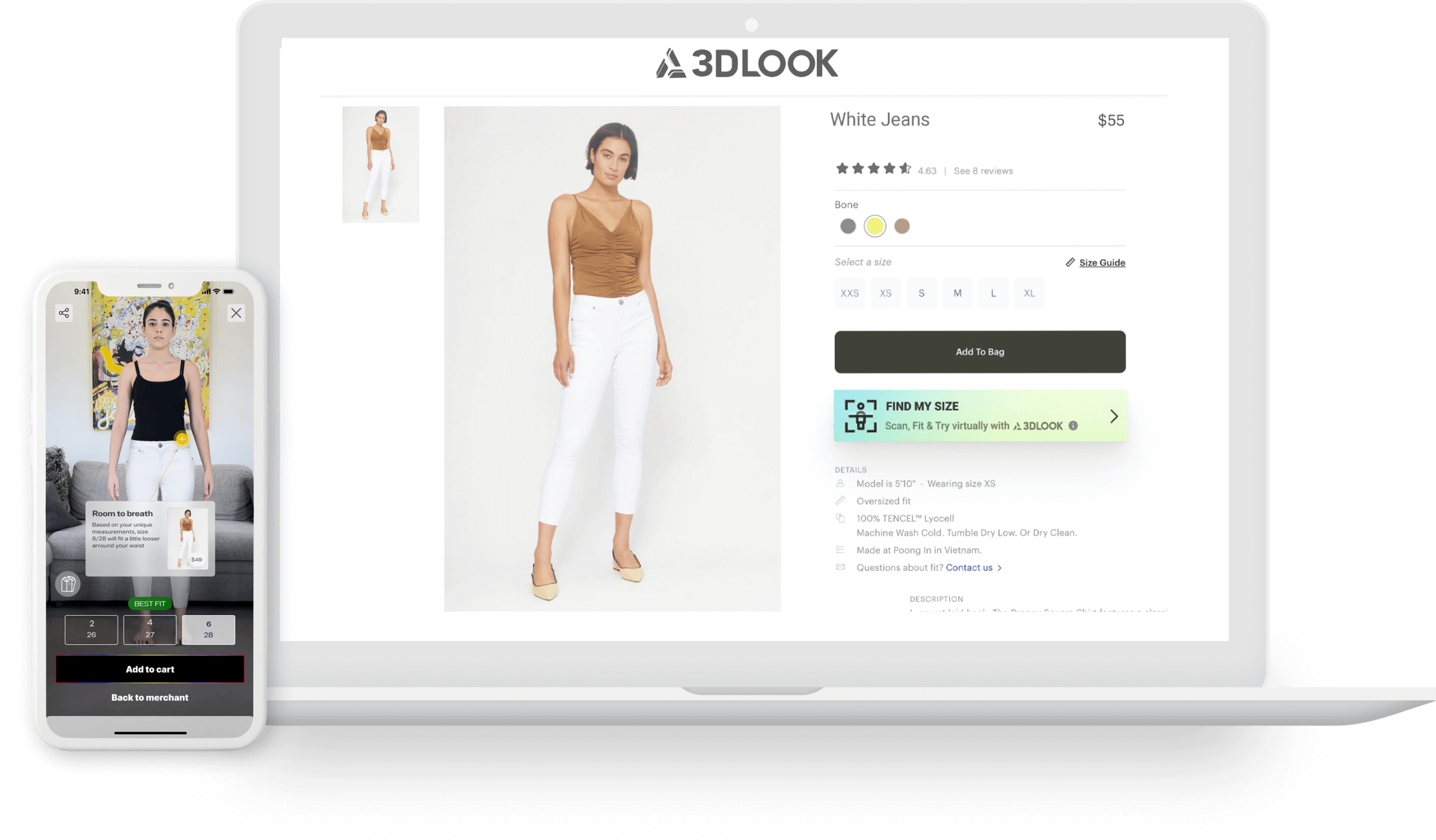

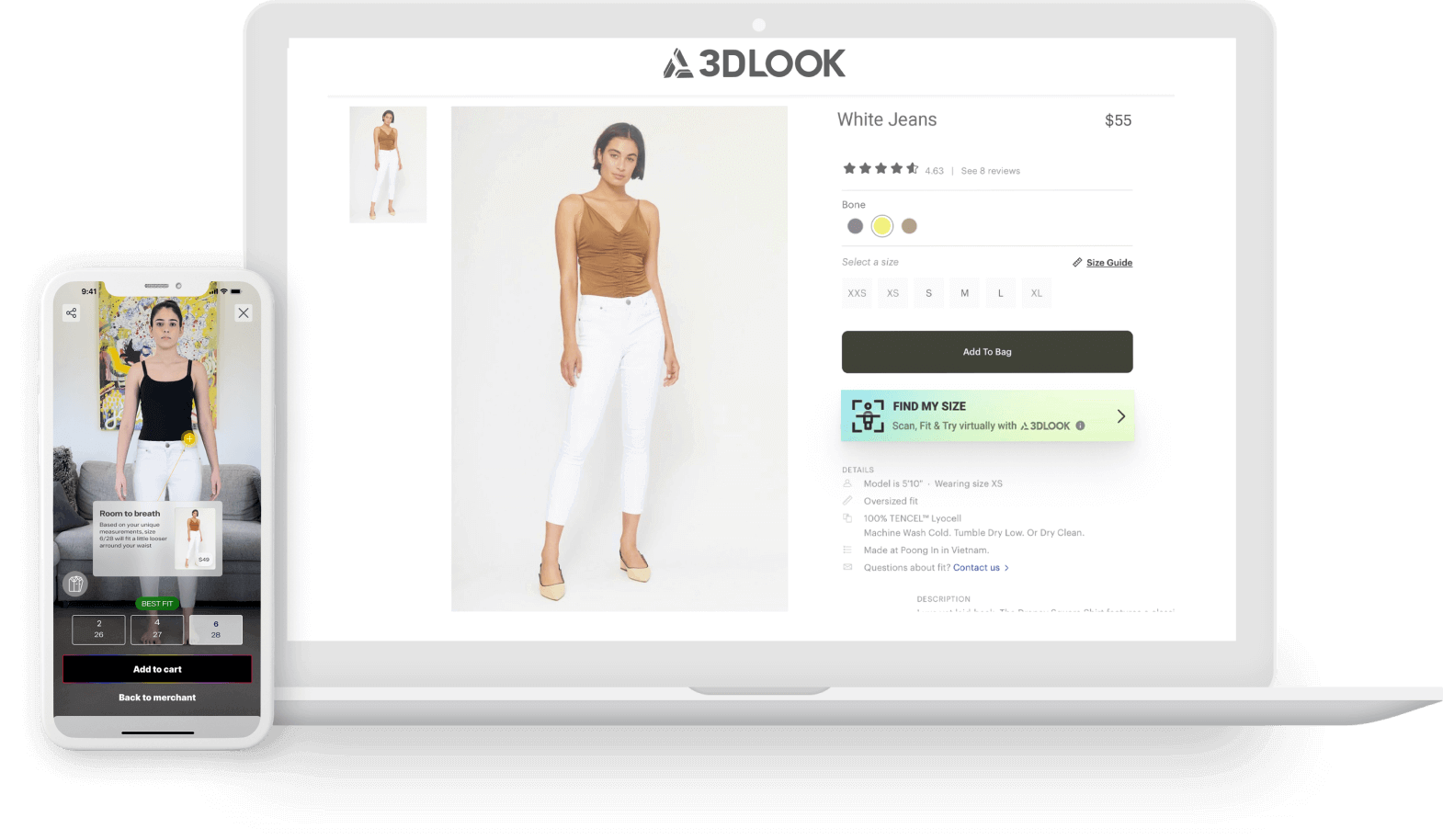

For instance, 3DLOOK’s virtual fitting platform, YourFit, enables customers to try on clothing and instantly find their perfect size by quickly snapping two photos on their smartphone. Powered by body data captured by 3DLOOK’s complex AI algorithms, YourFit’s virtual try-on and size recommendation technology provides customers with the confidence to shop — and without relying on returns. It’s a world away from the limited and uninspiring ecommerce experiences of yesterday.

The growth of the ecommerce fashion industry

Etailinsights estimates there are currently 9.1 million ecommerce retailers operating around the globe. Some 5.9m of these stores sell a single brand, with the remainder made up of marketplaces such as Amazon and Farfetch, which offer products from a wide variety of brands and boutiques.

Approximately 8.8m of those stores sell physical products, while an estimated 290,000 sell virtual goods. Most ecommerce clothing stores fall into the physical category. However, there are a handful of brands, such as DressX, The Fabricant and Tribute Brand, that are serving the growing demand for virtual fashion.

There’s no exact figure for how many of these online stores operate in the fashion sector. However, with clothing (51%), shoes (41%) and accessories (30%) the top three items most commonly purchased by online shoppers, according to Statista, fashion is undoubtedly one of the most competitive areas for online retailers. In fact, data from 2PM shows that 13 of the world’s top 20 direct-to-consumer brands operate in the fashion and apparel space. And these aren’t all just long-standing brick and mortar powerhouses, but also ecommerce trendsetters such as Shein and Gymshark.

Undoubtedly, competition in the ecommerce clothing market will only intensify as its value continues to soar.In 2024, online fashion sales are set to reach $1 trillion, up from $668 billion in 2021. By 2025, that value is expected to reach $1.2 trillion.

The world’s largest apparel ecommerce brands

That doesn’t mean any and every brand can expect a share of the riches. According to Statista, the world’s 10 biggest ecommerce businesses account for more than 60% of the revenue generated by online sales, while the market is expected to reach 464 billion USD in 2024.

China’s vast online marketplaces, in particular, dominate the fashion ecommerce space. Ranked by net online sales, JD — China’s largest retailer and the 15th largest in the world — places top with revenues of $17.8bn. This puts it far ahead of Shein and Vip.com, the world’s second and third largest fashion ecommerce platforms, which generated sales of $10.4bn and $7.7bn respectively. Coupang ($7.1bn) and H&M ($5.8bn) — the only ecommerce leader located outside of China — make up the top five.

Even in the United States, China’s Shein ranks top. A relatively new addition to fashion ecommerce’s top ranks, Shein owes its success to its complex algorithms that can determine the latest fashion trends and enable the constant design of new products. With over 6,000 additions added to its store every day, Shein has taken the fast fashion model and sped it up. Having generated $24bn in revenue in 2022, the ecommerce leader is close to overtaking established brick and mortar brands such as Zara and H&M.

In 2021, Shein recorded net ecommerce sales of $5.8bn in the US market, putting it ahead of Macy’s ($5.6bn), Amazon ($5bn), Walmart ($4.6bn) and GAP ($4.3bn).

Source: Statista

Source: Statista

The best ecommerce platform for fashion industry leaders: What solutions are leading brands using?

Today anyone can take their business online and begin selling to the masses through the various ecommerce platforms that are now available. These platforms provides a complete management system for online merchants, enabling them to manage inventories, process payments, market their products and fulfill orders through streamlined and intuitive interfaces.

But with customization and personalization top of the consumer wishlist, big brands surely can’t rely on out-of-the-box ecommerce solutions, which enable anyone to launch an online store, select a template and begin selling in just a few clicks…

It’s true that many major retailers opt for custom-built websites that have been created specifically to provide design and functionality that appeals to their customers. Given the importance of differentiation, this ensures that brands are providing an experience unlike any other. Yet, many market-leading retailers still opt for the convenience of off-the-shelf ecommerce platforms. Big name brands, such as fast fashion powerhouse Fashion Nova and athleticwear giant Gymshark, have turned to Shopify to power their ecommerce stores, for instance. Likewise, Fred Perry utilizes Adobe Commerce (formerly Magento), which today handles over $100bn in gross merchandise sales every year.

These platforms, and others such as WooCommerce and BigCommerce, are best known for removing complexity for brands that lack technical knowledge or money to invest. However, they also come with significant customization options and a vast number of plugins, which add additional tools and features to streamline business processes and enhance the customer experience. For instance, the YourFit platfom now has a plugin for Shopify, enabling brands to effortlessly unlock the virtual fitting room for their customers.

Which option is best for a particular retailer will depend on its business model, needs and goals. A custom-built website may well be the better option, but brands shouldn’t be too quick to discount the market’s leading ecommerce platforms.

Fashion ecommerce essentials: What are the must-haves for any online apparel store?

Ecommerce owes its growth to the ease, convenience and frictionless experiences that it provides. Or, at least, that it should provide. With 70% of all online shopping carts abandoned prior to checkout, according to nShift, even the most well-established retailers are losing out on customers due to their failure to get the fundamentals right.

Filtering and navigation

If customers had hours to spend browsing through poorly organized products, they would simply head to a physical store. As part of apparel ecommerce best practices, apparel retailers must provide a user-friendly website that makes it easy for shoppers to find outfits they love without scrolling through irrelevant products for hours on end.

Here, effective product filtering is essential, enabling shoppers to narrow down results based on factors such as size, fit, brand and price. With just 16% of ecommerce brands deemed to provide a satisfactory filtering experience, this is a simple way to get an upper hand over your competitors.

Social proof

Seeking social proof from those that have shopped with you previously is imperative, given 93% of new customers seek customer reviews before they commit to a purchase.

Particularly in the apparel space, reviews can be a powerful tool when combined with user-generated images, which enable shoppers to see how an item will look on bodies similar to their own. Shein, for instance, incentivizes its customers not only to leave reviews, but to include photos, through its points system. Customers receive five points for every review they leave, or ten if it includes a photo. For every 100 points they collect, they receive $1 of their next order. It’s a small cost that undoubtedly pays for itself in conversion-boosting social proof.

A mobile-friendly experience

Mobile commerce is tipped to hit $621bn by 2024, with almost half of all ecommerce purchases to be made through a mobile device, according to Shopify.

With 70% of consumers unwilling to return to a site after their first visit if it offers poor design or layout, according to Baymard Institute, creating a responsive storefront that looks good and functions well — no matter what device is being used — is imperative.

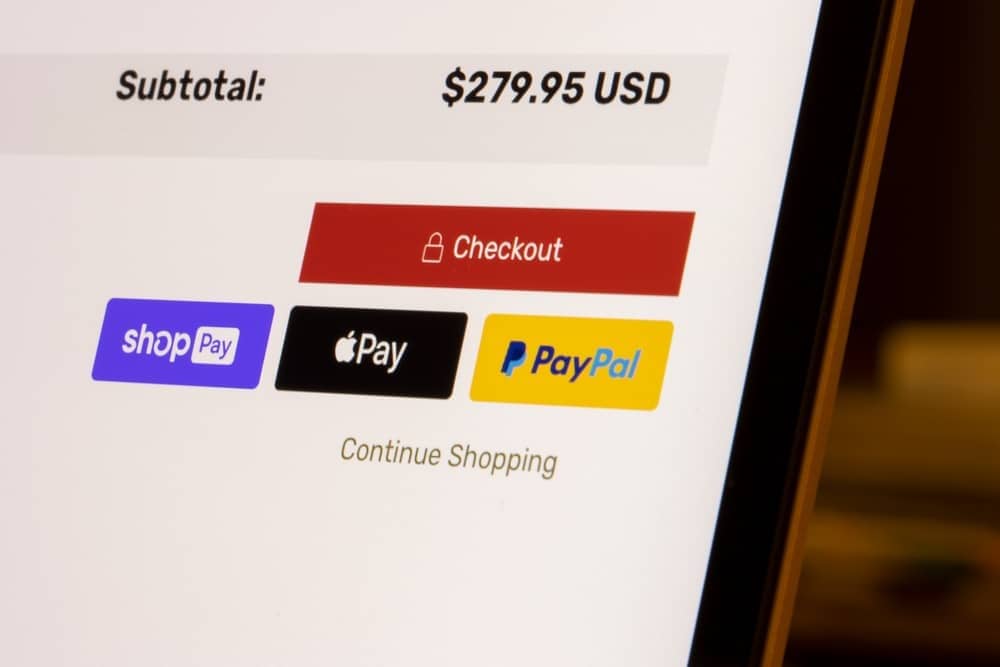

Payment options

There are thousands of different payment options in use today, each with their own pros and cons. Retailers don’t need to offer them all, but they do need to offer variety.

Many stores offer payments exclusively through credit or debit card. And yet, these methods are used for just 34% of transactions today (and that figure is expected to fall to 32%” by 2025). Some 49% of payments are made using digital and mobile wallets systems, such as Apple Pay and Google Pay.

Then there’s the increasingly popular Buy Now, Pay Later (BNPL) options, which allow customers to buy items and pay back the costs over a length of time. In 2016, BNPL was the payment method of choice for just 0.4% of global ecommerce transactions, according to Statista. Today, it’s used for more than 3% of online purchases — and growing.

But what do shoppers really want? How to appeal to the modern consumer

Basic functionality and features that offer ease and convenience are a necessity for online shoppers, but getting the basics right doesn’t set a brand apart from the millions of other online retailers.

According to McKinsey, fashion industry executives rank brand differentiation as one of the top three opportunities for apparel retailers in the year ahead — and here’s what consumers are looking for most:

Personalization

A one-size-fits-all ecommerce experience simply isn’t good enough for modern apparel shoppers… It goes without saying that customers living in hot climates don’t want to browse a selection of coats, and failure to recognize each shopper’s individual needs and desires can cost ecommerce businesses dearly. In fact, more than 80% now expect retailers to accommodate their preferences and 50% of all purchases are driven by personalization.

Size, fit, style, color, climate, age, gender, ethnicity and many other factors influence a particular customer’s purchasing habits. From ad campaigns to product recommendations and post-purchase emails, shoppers expect their entire experience to be personalized using the vast amounts of data that retailers collect.

Diversity & inclusion

Some 75% of young consumers state they would boycott brands they deem to discriminate against particular races or sexualities according to McKinsey.They don’t care how strong your brand name is or how many years you’ve served the market. If your business lacks social awareness, they will soon find somewhere else to shop.

Brands can show their commitment to improving D&I not only through the products they sell and marketing materials they release, but also through the ecommerce experience they provide. For instance, with 26% of Gen Z shoppers stating brands should avoid using gendered language according to Voxburner, simple measures — such as adding ‘gender nonconforming’ product filters and ranges — can show young consumers that you’re listening to their concerns.

Sustainability

Consumers want to shop sustainably (and not only the TikTok generation). According to Bain & Company, 65% of fashion consumers across all demographics care about the environment. However, identifying sustainable options poses a major challenge, with a third of Baby Boomer and Silent Generation shoppers stating that they struggle to find sustainability information for brands and products.

The solution to this is greater transparency. From clear product descriptions that inform customers of the materials and processes used, to product passports that offer insight into an item’s origins, leaders in sustainable fashion are open about the impact of their items. With 72% of shoppers stating that transparency is important or extremely important, according to Nielsen, brands will be rewarded for their honesty — so long as they’re taking steps to reduce their impact.

Experience

To set themselves apart, retailers must find creative ways to enhance the traditional ecommerce customer journey. Many customers don’t want to scroll through product lists, add an item to their cart and checkout immediately. They want experiences that go beyond the norm, and engage, excite and entertain them.

The likes of H&M and LV have invested heavily in gamified shopping experiences, for instance, which engage shoppers through mini-games and collectible items. Alternatively, retailers such as Nordstrom have implemented a virtual styling service where customers can book a video call with an expert to discuss their style and preferences, and receive tailored style advice.

In exchange for a customer experience that goes above and beyond, shoppers are happy to pay a premium of up to 16% and are more likely to return to a store time and time again, according to PwC.

Fashion eCommerce solutions and technologies for trend-setting retailers to consider

So how can retailers give shoppers what they want? Thankfully, there are an abundance of innovative fashion ecommerce solutions and technologies for brands to call upon, designed to support the apparel industry in delivering the ultra-inclusive, eco-friendly and highly engaging experiences that modern consumers desire.

Virtual fitting rooms

For 43% of consumers, the inability to try before they buy is the primary pain point that puts them off online shopping, according to Statista. Given the importance of size and fit, this is particularly problematic in the apparel space.

Virtual try-on technology replicates the physical fitting room in the digital world, enabling consumers to ‘try on’ apparel products by visualizing them on a avatar that shares their appearance. Using this technology, they can evaluate how different colors, patterns and styles will look on their body before they complete a purchase.

Alternatively, YourFit takes this a step further, utilziing 3DLOOK’s market-leading body scanning technology to create an avatar from the customer’s unique body measurements. Shoppers can try clothes on a 3D avatar that shares their looks and shape to instantly know whether an item will look good and fit well. Using this technology, retailers have been able to increase session length and product page views by up to 300%, while achieving up to 25% higher average order values and 16% greater conversion rates.

Synthetic media

Gen Z consumers command over $360bn in disposable income, but targeting them often proves difficult. They’re not like past generations — they live online, shop mindfully and are quick to turn their backs on brands they deem unsatisfactory.

Synthetic media (content created using algorithms that learn from audio, video, photos and text to generate realistic media), such as virtual influencers, allow brands to target young shoppers where they frequent most: social media. Utilized by big-name brands such as Yoox and Prada, these computer-generated characters mimic human influencers, but without the physical limitations and in a way that brands can control entirely.

AI chatbots

According to LivePerson, 83% of shoppers require assistance when shopping online, but waiting days for an email response hardly aligns with the speedy and convenient experience that ecommerce customers seek. For over half, failure to provide immediate support will put them off of making a purchase.

The solution is an artificial intelligence chatbot that can effectively communicate with customers when live chat support is unavailable. These rapidly-developing solutions are capable of answering customers’ queries and helping them to find the products they desire (without delay).

Retail media networks

As governments tighten their data privacy laws, fashion ecommerce marketing is becoming more costly and less effective. Today, brands have to spend three times the amount they did in 2013 to acquire a customer, according to McKinsey.

With brands required to rethink their marketing strategies, many are turning to retail media networks (RMNs) — retailer-owned advertising platforms that sell ad space on their websites and apps. Allowing brands to reach highly-engaged consumers when they’re in a purchasing mindset, 79% of US apparel executives rate the performance of RMNs as superior to other marketing channels.

Social commerce

Today, the likes of Facebook, Instagram and TikTok allow users to purchase goods directly through their platforms, so why would young consumers bother visiting an ecommerce store when they can make purchases directly through the apps that they frequent most?

According to Insider Intelligence, social commerce in the US alone will account for nearly half (50.3%) of all social media users in 2024. Likewise, social commerce is expected to generate $3.4T in sales by 2028, growing at an annual rate of 28.4%. To capture a share of this revenue, brands must make use of tools such as shoppable posts, in-profile storefronts and live streaming.

Measuring ecommerce success: KPI benchmarks for fashion e-commerce brands

No two fashion brands are the same and metrics will vary considerably depending on a range of factors, including product categories, price range, customer demographics, location and more. That said, by measuring their own metrics against industry benchmarks, brands can gain insight into how they’re performing and assess whether changes may be necessary.

Customer acquisition cost (CAC)

On average, the cost of acquiring a customer in the fashion ecommerce space is estimated at $129 by Shopify. This includes advertising costs, marketing salaries, commissions, bonuses and any overhead required to capture and convert new customers.

Conversion rate

On average, fashion ecommerce conversion rates stand at 2.2%, according to Oberlo. However, LittleData found that the top 10% of stores achieve conversion rates of up to 4%, while the worst performing 20% maintain a conversion rate of just 0.4%.

Discover the strategies market-leading brands use to boost their conversion rates in our comprehensive e-book:

Average order value (AOV)

Yopto data shows that the AOV for fashion ecommerce stores is approximately $97. However, this varies significantly depending on the popularity of the retailer. For stores with less than 1,000 monthly orders, the average sits at $108. However, for those with 10,000+ monthly orders, AOV falls to just $49.

Units per transaction (UPT)

According to XP2, the average UPT rate for fashion ecommerce stores stands at 2.61. This is lower than other categories, such as consumer goods (3.1) and pet care (4.06).

Sell-through rate

Data from Accelerated Analytics shows that the average sell-through rate for apparel stands at approximately 24.3% after two months and 45.5% after six months. Within a year, brands can expect to sell 68.7% of their initial stock.

Return rate

The average return rate for fashion ecommerce is approximately 30%. However, return rates can be as high as 40% in some categories and reach up to 50% following a holiday period.

Standard vs luxury fashion ecommerce: How do the metrics differ?

Luxury fashion comes at a premium. As a result, customers spend more time thinking over their purchases and are less likely to commit without seeing, touching and trying it on first. As a result, luxury fashion ecommerce conversion rates are typically lower, with Dynamic Yield data showing just 1.5% of visitors go on to make a purchase.

When luxury fashion ecommerce stores do convince a customer to make a purchase, they’re typically rewarded highly for their efforts. According to Statista, the average AOV for luxury fashion stands at $244.66 — more than double that of a standard apparel transaction.

However, a higher price tag means higher expectations and, when a product falls short, customers are far more likely to request a return. While few brands are transparent when it comes to return rates, the industry estimates that as much as half of all purchases in some luxury segments are shipped back.

Staying competitive in the ecommerce clothing sector

Big fashion brands have a competitive advantage in the fast-growing fashion ecommerce space, but a recognizable name and established customer base alone won’t maintain success in the online fashion space.

Providing ease and convenience is unequivocally important for the 2.64 billion online shoppers worldwide – the expected number according to GrowthDevil. No online fashion store will achieve results without meeting the most basic of ecommerce consumers’ demands. However, to really capture the market, brands must invest in innovative solutions and create unique experiences that truly engage shoppers, giving them the push they need to make a purchase.

Where are ecommerce fashion trends heading?

The landscape of e-commerce competition will persist in its intensity during the course of 2024, with customer experience (CX) emerging as the pivotal discriminator. In an era where online shopping transcends national borders, transforming into a truly global pursuit, the trend of consumers seeking brands and products from an expansive international array is on the rise. Consequently, fashion brands are compelled to adopt a multi-local commerce strategy, ensuring a harmonized buying experience for shoppers across the globe.

Drawing insights from the most recent data, it’s anticipated that the ‘Buy Now, Pay Later’ (BNPL) alternative will undergo a substantial surge in popularity within the domain of fashion e-commerce throughout 2024. Furthermore, a persistent inclination toward more sustainable alternatives is expected to persist.

In terms of technology, the combination of artificial intelligence, augmented reality, and the metaverse stands as a transformative force. This convergence is poised to overhaul the dynamics of customer interaction within the online fashion sector.

YOURFIT

A simple, user-friendly, and intuitive fit personalization platform that helps shoppers find the best size clothing while also providing an engaging try-on experience!

Tags:

Fashion

EXPLORE MORE CONTENT

Subscribe to our Newsletter

Offer your customers an entirely new, inclusive, and engaging way to interact with your brand

Offer your customers an entirely new, inclusive, and engaging way to interact

with your brand

Let us help you find the right solution for your business needs